Getting out of debt is a challenge that many people face, but with the right strategies, it’s possible to regain financial control and rebuild stability. The first step is recognizing the problem and committing to change. In this article, I will guide you through each necessary step, from mapping out your debts to prioritizing them effectively, helping you turn a financial crisis into a fresh start.

Debt often arises from poor financial planning, unexpected emergencies, or a lack of financial education. Identifying the root cause is crucial to preventing future financial pitfalls. That’s why this guide is not just about paying off debt—it’s about building a solid path toward financial freedom.

If you’re struggling with debt, you’re not alone, and there are real solutions available. Follow this step-by-step guide to take back control, organize your finances, and develop sustainable financial habits. Let’s get started!

Table of Contents

Understanding the Root Cause: Why Are We in Debt?

Before taking any action, it’s important to understand how you got into debt in the first place. Debt problems often stem from repetitive financial behaviors and poorly planned choices. But how do you identify these patterns?

- Analyze Your Spending Habits: Do you spend more than you earn? Do you rely on credit cards excessively? Tracking your spending is essential to understanding the root cause.

- Consider External Factors: Medical emergencies, job loss, or unexpected expenses can disrupt even the best financial plans. Recognizing whether your debt was avoidable or unavoidable helps in crafting the right solutions.

- Lack of Financial Planning: Many Americans struggle with financial literacy, leading to decisions made without fully considering the consequences. The good news is that financial habits can be improved, and you can take control of your situation.

Mapping Out Your Debt: Understanding the Full Picture

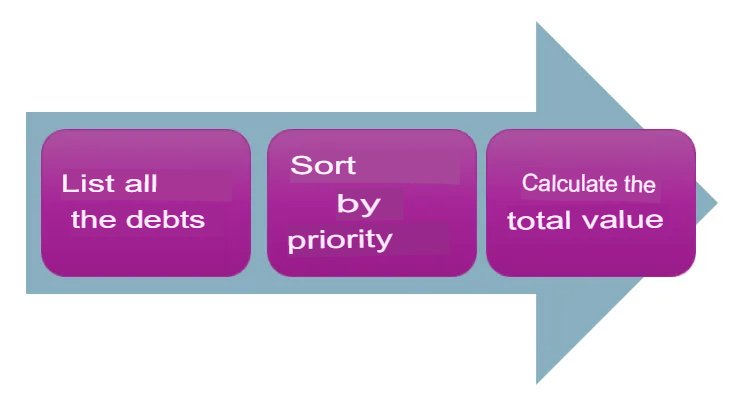

Before creating a repayment strategy, you need a clear view of your total debt. Here’s how to assess your financial situation in three steps:

- List All Your Debts: Gather detailed information about each outstanding balance, including amounts owed, interest rates, due dates, and creditors. Using a spreadsheet or financial planning app can help.

- Prioritize by Urgency and Interest Rate: High-interest debts, such as credit cards and payday loans, should be your top priority since they grow the fastest over time.

- Calculate the Total Debt Amount: Many people underestimate their total debt burden. Adding everything up gives you a realistic view of what needs to be paid off.

By completing this step, you’ll have a clear understanding of your financial situation, allowing you to make informed repayment decisions.

Prioritizing Debt: Choosing the Right Repayment Strategy

Once you’ve mapped out your debts, it’s time to choose a repayment strategy. The two most popular methods are the Avalanche Method and the Snowball Method.

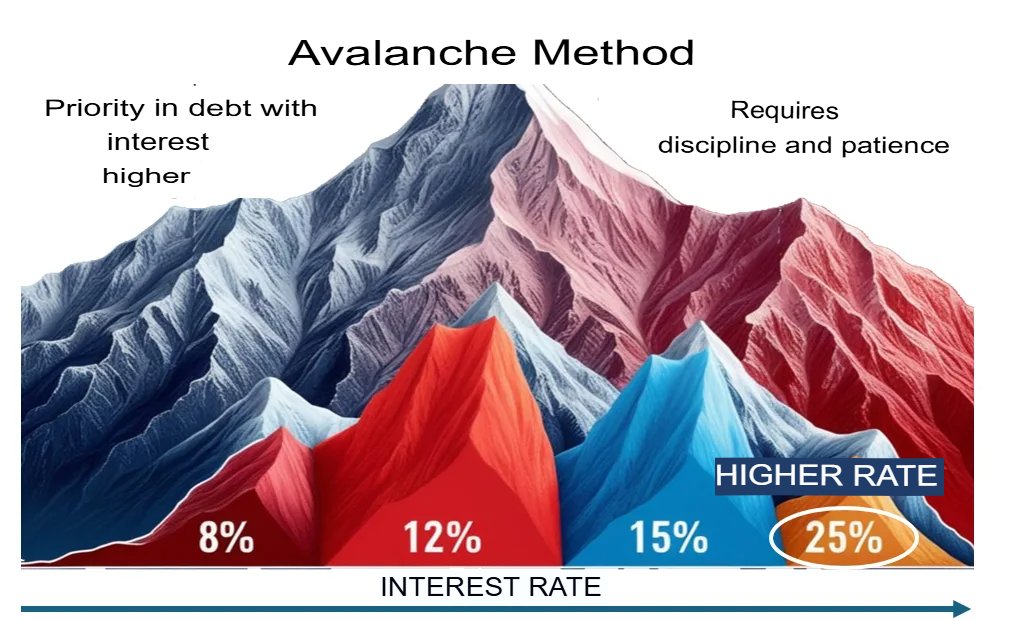

1. Avalanche Method: Paying Off High-Interest Debt First

This strategy focuses on paying off debts with the highest interest rates first. While it saves more money in the long run, it may take longer to see noticeable progress.

📌 If you are patient and financially disciplined, the Avalanche Method is for you.

- List all your debts, ordering them from highest to lowest interest rate.

- Pay the minimum required amount on all debts.

- Allocate any extra funds toward the debt with the highest interest rate.

- Once the highest-interest debt is paid off, focus on the next one.

For example, if you have a mortgage at 5%, a car loan at 7%, and a credit card debt at 20%, you should prioritize paying off the credit card debt first.

This method minimizes the amount paid in interest over time, making it the most cost-effective approach.

2. Snowball Method: Paying Off Small Debts First

This approach prioritizes smaller debts first, regardless of interest rates. It creates quick wins, which can boost motivation to stay on track.

📌 If you struggle with financial motivation, the Snowball Method might be better suited for you.

- List all your debts from smallest to largest (ignoring interest rates).

- Pay the minimum on all debts while putting any extra money toward the smallest balance.

- Once the smallest debt is eliminated, move on to the next smallest, and so on.

For example, if you have a $500 medical bill, a $2,500 credit card balance, and a $10,000 car loan, you would pay off the $500 bill first. The psychological boost of eliminating a debt quickly can help maintain motivation.

📌 A hybrid approach can also work: Start with the Snowball Method for motivation, then switch to the Avalanche Method to save money on interest.

Negotiating with Creditors

Creditors are often willing to negotiate payment plans, interest rate reductions, or settlement offers. Before reaching out, research your options and be prepared to discuss terms that fit your budget.

📌 Regardless of the method you choose, the key is to stick to your plan and avoid accumulating new debt during the process.

Where to Start Paying?

When deciding which debts to tackle first, follow these guidelines:

- Essential Bills: Prioritize rent/mortgage, utilities, and groceries to maintain stability.

- High-Interest Debt: Tackle credit card debt and payday loans first to prevent them from spiraling out of control.

- Secured Loans: Make sure to keep up with car or home loan payments to avoid repossession.

- Consumer Debt: Pay off personal loans or installment payments next, ensuring they don’t affect your monthly budget.

Managing Credit Card Debt

Credit card debt is one of the most expensive forms of borrowing due to high interest rates. Here’s how to manage it effectively:

- Stop using credit cards while paying down your balance.

- Contact your credit card provider to negotiate lower interest rates or request a structured repayment plan.

- If possible, consider a lower-interest personal loan to consolidate your credit card debt.

- Always pay more than the minimum due to reduce the principal balance faster.

When to Consider Loans or Refinancing?

In some cases, taking out a lower-interest loan to pay off high-interest debt can be a smart move. However, this strategy must be used wisely.

| Loan Type | Average Interest Rate (Annual) | Pros | Cons |

| Personal Loan | 8-12% | Fixed payments, lower interest than credit cards | Requires good credit score |

| Home Equity Loan | 4-7% | Very low interest rates | Risk of foreclosure |

| Balance Transfer Credit Card | 0% (intro rate) | No interest for 6-24 months | High fees if not paid off in time |

📌 Always compare loan terms carefully, and make sure the new debt structure actually lowers your financial burden rather than extending it unnecessarily.

Real-Life Success Stories

Hearing about real people who conquered debt can be inspiring:

- Emily, 35: Used the Snowball Method to pay off $20,000 in credit card debt in two years.

- Michael, 50: Refinanced his mortgage, reducing his interest rate and saving $400 per month.

- Sarah, 28: Took a second job for a year and eliminated $15,000 in student loans.

How to Manage Your Credit Score and Debt in the U.S.

In the U.S., three major credit bureaus track financial history and debts, similar to the SPC in Brazil:

- Equifax

- Experian

- TransUnion

These agencies compile credit reports and determine your credit score, which is crucial for obtaining loans, credit cards, and even renting an apartment.

Where to Check Your Credit and Debt Status

You can monitor your credit score and reports using free services like:

- Credit Karma: Provides free credit reports and personalized recommendations to improve your credit score.

- Credit Sesame: Offers free credit monitoring, alerts on report changes, and financial tips.

- AnnualCreditReport.com: The official website where you can request your free credit report from all three bureaus once a year.

Keeping an eye on your credit score helps prevent identity theft, detect errors, and improve your financial stability.

FINAL INSIGHTS

Overcoming debt requires commitment and habit changes. Here are the key takeaways:

- List all your debts and calculate the total amount.

- Prioritize debts with the highest interest rates or those easiest to pay off.

- Choose a repayment strategy: Avalanche or Snowball.

- Negotiate with creditors for better terms.

- Monitor your credit report and avoid new debts while paying off existing ones.

With focus and discipline, you can transform your relationship with money and achieve the financial freedom you desire. Now it’s time to take action!

- Caixa Launches Fun Money Game on Roblox

- Easy Ways to Get Robux in Roblox

- Get Free Roblox Items This March

- How to Earn Free Robux Online

- 🍔 Why McDonald’s Became a “Luxury Meal”: The Real Reason Behind the Prices (And How to Beat Them in 2025)