“Need money fast and not sure where to start? Emergencies happen, and sometimes the only option is a loan. But choosing the right type can save you from a major headache! Learn about the options, their risks, and how to make the best decision.”

Table of Contents

Introduction

Loans are part of many people’s and businesses’ financial routines. Whether it’s for realizing a dream, investing in a business, or resolving financial emergencies, understanding the different options is crucial for making informed decisions. In this article, we will explore the main types of loans, explain their features, and provide tips on how to choose the one that suits your needs.

1. What is a Loan and How Does it Work?

A loan is a financial transaction where an institution, such as a bank or a fintech company, provides a sum of money to an individual or business with the obligation to repay it in installments, plus interest.

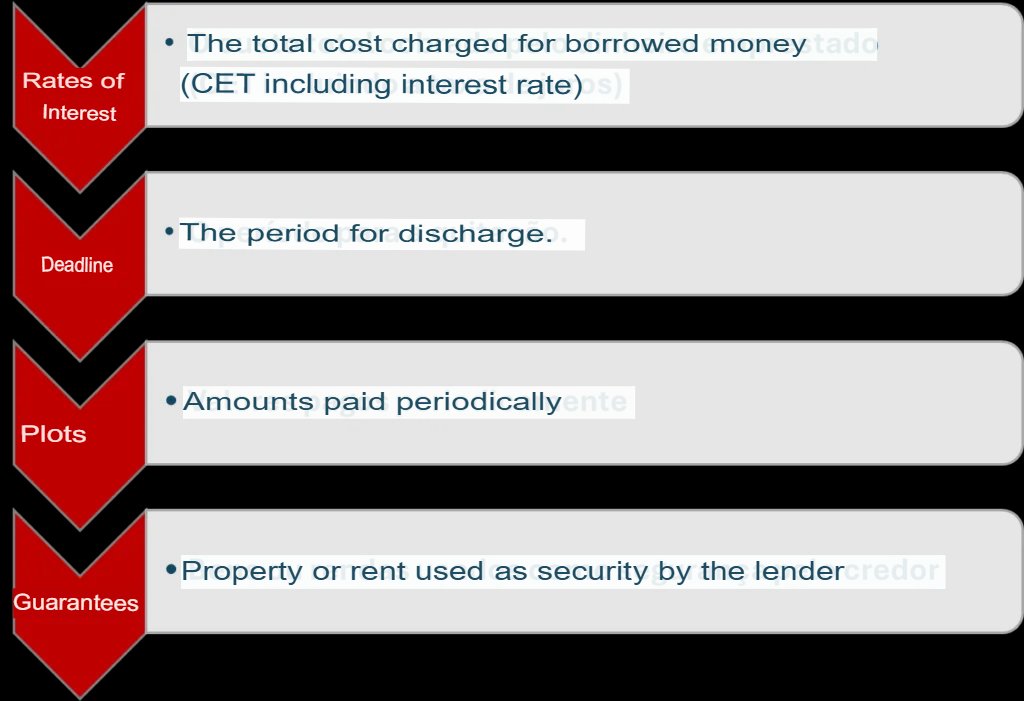

Key elements of a loan:

- Loan Amount: The principal amount borrowed.

- Interest Rate: The percentage added to the principal.

- Repayment Period: The length of time to repay the loan.

- Guarantees: Any collateral required by the lender.

By understanding these four elements, you can avoid surprises and better plan how to use the loan.

2. Main Types of Loans Available

2.1 Personal Loan: Simple, But with High Interest 💡

- When it’s recommended: For emergencies or personal expenses with no specific purpose.

- Advantages: Quick approval and no collateral required.

- Disadvantages: Higher interest rates compared to other options.

2.2 Payroll Loan – Lower Interest, But Not for Everyone 🔑

- How it works: Payments are automatically deducted from the borrower’s paycheck.

- Who can apply: Government employees, retirees, pensioners, and workers from partnered companies.

- Benefits: Reduced rates due to the security of automatic repayment.

2.3 Vehicle Financing

- Difference: Financing involves monthly payments, whereas leasing is more like renting with the option to buy.

- Caution: Watch out for interest rates and additional costs.

2.4 Mortgage Financing

- Main lines: Conventional mortgage loans and government-backed loans.

- Highlights: Long repayment terms and competitive rates.

2.5 Business Loans

- Recommendation: For working capital or business expansion.

- Types: Credit lines with or without collateral, such as receivables financing.

2.6 Online Loans

- How it works: Borrowers can access loans directly from other individuals, bypassing large financial institutions.

- Types: Peer-to-peer (P2P) lending and offerings from fintech companies.

- Benefits: Convenience and attractive interest rates.

- Caution: Be wary of unreliable platforms.

2.7 Student Loan

- Types: Federal student loans and private loans from banks.

- Who can apply: Students enrolled in undergraduate, technical, or graduate programs. Federal loans often require income qualifications and an SAT score.

- Highlights: The possibility to finance education without relying solely on personal or family funds.

- Caution: Watch out for interest rates, especially with private loans. Check the repayment terms to ensure you can afford payments after graduation, and avoid borrowing more than you can repay.

2.8 Credit Card Loan

A credit card offers a revolving credit line, meaning users can make purchases up to a set limit and, if unable to pay the full balance by the due date, can finance the remaining balance.

How it works:

- Credit Use: The card offers a pre-set credit limit. If the holder doesn’t pay the full bill on time, they can pay a minimum amount, which immediately accrues high interest on the balance.

- Revolving Credit: If the full balance isn’t paid, the remaining balance carries over into revolving credit, where the borrower can make partial payments or finance the remainder.

- Interest Rates: Credit card interest rates are high, ranging from 10% to 15% per month (or higher), depending on the bank and the borrower’s profile. This makes the cost of borrowing quite high if the payment is not paid in full.

Consequences of Non-Payment:

- High Interest: As mentioned, revolving credit interest rates can be extremely high, which can lead to a growing, hard-to-manage debt.

- Credit Score Impact: Failure to pay the balance can result in the borrower being listed in the credit bureaus (like Experian or Equifax), making it harder to obtain credit in the future.

- Legal Action: Prolonged non-payment may result in legal action for debt recovery.

2.9 Overdraft Protection

Overdraft protection is a pre-approved credit limit on your checking account that allows you to make withdrawals or payments even when there’s insufficient balance. This credit is typically used in emergencies, but it’s important to know how it works.

How it works:

- Credit Limit: The bank provides a credit limit to use beyond the balance of your checking account. If the balance goes negative, the overdraft protection kicks in automatically.

- Instant Loan: You can use the overdraft protection to make withdrawals, pay bills, or transfer money to other accounts. This credit is quick and easy to access, but comes with high-interest rates.

- Interest Rates: Overdraft protection interest rates are also high, ranging from 8% to 15% per month, depending on the bank. Like credit cards, debts can accumulate quickly if not paid within the agreed period.

- Daily Interest Charges: The interest on the overdraft balance is charged daily, making the cost even higher the longer the balance remains negative.

Consequences of Non-Payment:

- High Interest: If you continue to use the overdraft protection without paying, the daily interest charges can cause the debt to grow rapidly.

- Credit Score Impact: Non-payment can lead to negative entries in credit reports.

- Legal Action: Prolonged delinquency may result in the bank seeking legal action.

3. How to Compare Different Types of Loans

Choosing the best loan requires considering several factors. Here are the key ones:

3.1 Interest Rate: Compare fixed (set rate) vs. variable (fluctuating) rates.

3.2 Terms and Conditions: Check if the loan term matches your financial capabilities.

3.3 APR (Annual Percentage Rate): The APR includes all loan-related costs, such as:

- Interest Rate: The main rate applied to the borrowed amount.

- Application Fees: Some lenders charge administrative fees or credit evaluation charges.

- Insurance: If the loan requires insurance (e.g., life or financial protection insurance).

- Taxes: Any taxes applied to the loan.

- Late Fees and Penalties: Additional charges for late payments.

- Other Additional Fees: Like transaction fees, registration charges, etc.

Importance of APR

The APR allows consumers to compare loan offers more fairly. While one loan may seem to have a lower interest rate, its APR may be higher due to extra costs, like insurance or fees.

Transparency: The APR is a legal requirement, ensuring greater clarity in credit conditions. Financial institutions must display it clearly in loan contracts.

Example:

Let’s compare two loans:

- Loan with 3% interest and 5% APR.

- Loan with 3% interest and 6% APR.

Although the first loan has a lower interest rate, the APR is more important because it includes all loan costs. Therefore, the loan with the 5% APR may be the better choice, as it’s cheaper overall.

Loan Comparison Table by Type

| Loan Type | Interest Rate (%) | Term (months) | Collateral Required |

|---|---|---|---|

| Personal Loan | 3% to 8% | 12 to 48 | No |

| Payroll Loan | 1% to 2.5% | 12 to 96 | No |

| Vehicle Loan | 1.5% to 3% | 24 to 60 | Yes (Vehicle) |

| Mortgage Loan | 0.9% to 1.8% | 120 to 360 | Yes (Property) |

| Online Loans | 2% to 5% | 6 to 36 | Varies (depends on platform) |

| Credit Card | 10% to 15% per month | Monthly (Renewable) | No |

| Overdraft | 8% to 15% per month | Monthly (Renewable) | No |

Consequences of Non-Payment Table

| Loan Type | Interest Rates | Repayment Period | Collateral | Consequences of Default |

|---|---|---|---|---|

| Personal Loan | High | Short to medium term | None | Higher interest, credit report damage, potential legal action. |

| Payroll Loan | Low (fixed rates) | Medium to long term | Paycheck or benefits | Direct deduction from salary, credit report damage, potential legal action. |

| Secured Loans | Medium to low | Medium to long term | Property or vehicle | Loss of collateral, credit report damage, legal action. |

| Student Loan | Low (subsidized) | Long term | None | Credit report damage, higher interest, difficulty obtaining credit. |

| Credit Card | Very high | Short term (monthly) | None | High interest, credit report damage, potential legal action. |

| Overdraft | High | Short term (monthly) | None | High interest, credit report damage, legal action. |

4. What Factors to Consider Before Choosing a Loan?

- Purpose: Determine why you need the money.

- Repayment Capacity: Assess the impact on your budget.

- Flexibility: Check options for renegotiation or early repayment.

5. How to Avoid Common Loan Mistakes

- Ignoring APR: Always factor in the total cost of the loan, including fees and charges.

- Borrowing More Than Needed: Avoid unnecessary debt.

- Not Comparing Options: Always compare offers from different lenders.

Final Thoughts

We’ve seen that taking out a loan can be a solution in times of need, but it’s essential to do it wisely. Knowing the different loan types and their characteristics is the first step to avoiding financial problems in the future. Always research, compare, and read the contracts carefully before making a decision. Check the APR!

Got questions on which loan to choose? Leave a comment or share this post with someone who could use these tips!

Want to take your financial knowledge even further? 📚💡 Check out our other posts for expert insights, practical tips, and strategies to help you build a secure and prosperous financial future. Explore More Now!

- Caixa Launches Fun Money Game on Roblox

- Easy Ways to Get Robux in Roblox

- Get Free Roblox Items This March

- How to Earn Free Robux Online

- 🍔 Why McDonald’s Became a “Luxury Meal”: The Real Reason Behind the Prices (And How to Beat Them in 2025)