Table of Contents

Family financial planning in your spending routine

Financial planning is one of the most important practices to ensure stability and security in your daily life. When implemented well, it not only reduces the stress caused by financial problems, but also creates a foundation for future dreams, such as buying a house, paying for your children’s education or enjoying a smooth transfer. Small, consistent actions, included in your family’s daily routine, have the power to transform the financial life of any family.

Although it may seem like a challenge, establishing a routine to manage expenses is simpler than many people imagine. Many families end up neglecting this habit, but the secret is to take small steps that are easy to implement and that, when accumulated, generate great results. Let’s explore how to build this routine in an efficient and accessible way.

Whether you are looking to get out of debt or simply improve your financial health, this article will provide practical insights and tools to achieve this goal. Mastering your finances is a journey, and the first step is to start with planning and organization.

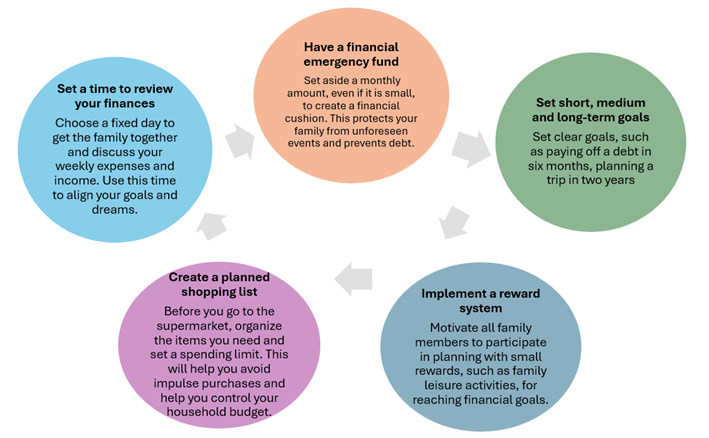

Tips and Routines to Facilitate Family Financial Planning

Creating a family financial planning routine requires more than just good intentions. Here are some practices you can implement to simplify the process:

With these routines in place, it will be easier to create consistent habits and achieve your financial goals. Remember: success in financial planning starts with small, conscious daily actions.

Before vs. After adopting financial planning

| Situation | Before | After |

| Expense control | Disordered spending | Organized spending |

| Debt | Frequent | Reduced |

| Savings | Practically non-existent | Guaranteed monthly reserve |

| Achieving goals | Difficulty | More achievable |

| Financial stress | High | Reduced |

This chart illustrates how small changes can generate big results.

Concepts of Expenses x Income in the Budget of the family’s spending routine

Expenses are what you SPEND (Outgoings) while Income is what you RECEIVE (Incomings)

Why is Family Financial Planning Essential for Your Spending Routine?

Having a family financial plan goes beyond organizing numbers and spreadsheets. It’s about creating a healthy relationship with money and ensuring that it is used as a tool to achieve goals. Without a clear plan, it’s easy to fall into traps such as debt, impulsive spending, and a constant feeling of insufficiency.

One of the great benefits of this practice is forecasting. When you know your expenses and income, you can anticipate potential difficulties and prepare for them. In addition, planning allows you to identify waste and reallocate resources to real priorities, such as investments and savings.

Another important point is family unity. Working together to manage finances creates a sense of shared responsibility and promotes dialogue. This way, everyone feels part of the process and contributes to collective financial success.

The Power of Small Actions in Routine and Spending Control

A significant change doesn’t have to start with big revolutions. Small daily actions, such as writing down your expenses or avoiding impulse purchases, can make a significant difference over time. These actions are simple to implement, but also easy to ignore – and this is where the secret to progress lies.

For example, setting a weekly budget for purchases prevents overspending and helps you stay in control. Other actions include reviewing credit card bills for unnecessary charges or renegotiating service contracts, such as internet and telephone.

Remember: consistency is more important than intensity. A small effort repeated over months or years can generate impressive results. The important thing is to stay focused on the long term and not get discouraged by small setbacks.

How to Create a Successful Family Spending Routine

Establishing an effective routine requires organization and commitment. The first step is to bring all family members together for an honest conversation about their current financial situation. This helps align expectations and set joint goals, such as paying off debt or saving for a trip.

Next, it’s essential to create a detailed budget. List all sources of income and all expenses, dividing them into categories such as housing, food, transportation, and leisure. This clear view of money coming in and going out is essential for identifying where excesses are and opportunities for savings.

Finally, implement the habit of reviewing your finances regularly. Set aside one day each week or month to evaluate your spending, adjust your budget, and discuss progress with your family. Consistently doing this process ensures that everyone remains aligned and committed to your goals.

Benefits of a Well-Established Financial Routine

Creating a routine for family financial planning brings several benefits. One of the main ones is stress reduction. Knowing exactly how money is being spent eliminates insecurity and allows you to make more informed decisions.

In addition, a well-structured routine makes it possible to save and invest consistently. Even small monthly savings, when applied to investments, can generate significant returns in the long term. This is the path to achieving financial independence.

Another benefit is the strengthening of family ties. Working together towards financial goals creates a stronger connection and encourages open dialogue. This helps to build a culture of responsibility and cooperation within the home.

Avoiding Common Mistakes in Family Planning

Even with the best intentions, it is common to make mistakes in family financial planning. One of the most common is underestimating expenses. Small and seemingly insignificant expenses, such as coffee or paid apps, can add up to considerable amounts over the course of the month.

Another mistake is not including the entire family in the process. When only one person takes control of the finances, the other members may not feel committed or may even generate conflicts. Active participation from everyone is essential for success.

Finally, avoiding reviewing and adjusting the plan can compromise results. Finances are dynamic, and unforeseen events happen. Maintaining a regular review ensures that the plan remains relevant and efficient.

To Remember: Final Insights

To master family financial planning, it is important to stay focused and adopt simple but consistent habits. Small daily actions can generate big changes over time. Here are the main points for you to remember:

- Get the family together to discuss goals and align expectations.

- Create a detailed budget with all income and expenses.

- Use technological tools or traditional methods to organize your expenses.

- Review and adjust your planning regularly to maintain progress.

- Avoid mistakes such as underestimating expenses or neglecting family dialogue.

With dedication and organization, you can transform your family’s financial routine and build a more peaceful and prosperous future. Get started today!