The investor profile is one of the first steps for anyone looking to start their journey in the world of investments. Knowing your profile helps align your financial choices with your goals and risk tolerance, ensuring safer and more informed decisions. Whether you’re a beginner or an investor looking for more customization, identifying your profile can transform your experience in the market.

In this article, we will explore how to discover your investor profile, the main types, and how each one relates to your financial goals. We’ll also present practical tools and an interactive questionnaire to make this process easier. Let’s dive in!

Table of Contents

What is an Investor Profile and Why Does It Matter?

An investor profile is an analysis that considers personal characteristics such as risk tolerance, financial goals, and investment horizon. Essentially, it helps understand how you react to gains and losses in the market, allowing you to structure a portfolio aligned with your preferences.

Knowing your profile matters because it reduces anxiety and increases the chances of success by tailoring your financial choices to your reality. For instance, while a conservative investor seeks stability, an aggressive one aims for high returns, even with high risks. Understanding this helps avoid impulsive decisions that could jeopardize your wealth.

Moreover, financial institutions use the profile to offer more suitable products. Therefore, knowing your own profile empowers you to evaluate these recommendations and build an efficient strategy.

The Main Investor Profiles: Conservative, Moderate, and Aggressive

In the financial market, there are three main investor profiles. Each reflects the relationship between the risk you’re willing to take and the results you aim to achieve. Here’s a look at the characteristics of each:

| Characteristic | Conservative | Moderate | Aggressive |

|---|---|---|---|

| Risk Tolerance | Low: Prefers stability and safety. | Medium: Willing to take some risk for gains. | High: Seeks to maximize returns, even with losses. |

| Primary Goal | Preserve capital. | Balance security and return. | Exponential growth of wealth. |

| Time Horizon | Short to medium term. | Medium to long term. | Long term. |

| Investment Examples | Fixed-income securities, CDs, Treasury bonds. | Multi-market funds, blue-chip stocks. | Emerging market stocks, equity funds, cryptocurrencies. |

| Ideal For | Those who cannot tolerate fluctuations. | Those seeking a balance between security and returns. | Those who understand and accept market volatility. |

1. Conservative

A conservative investor prioritizes capital preservation, opting for low-risk investments. This profile seeks safety, even if the returns are lower. Investment examples include:

- Fixed-income securities, such as Treasury bonds.

- Certificates of Deposit (CDs).

- Fixed-income funds.

Conservative investors generally have a short to medium-term horizon and value liquidity — the ability to quickly access invested funds.

2. Moderate

The moderate profile is a balance between safety and return. This investor is willing to take on some risks to boost gains, but without compromising a large portion of their wealth. Their choices include:

- Multi-market funds.

- Corporate bonds and other private debt securities.

- Blue-chip stocks.

Moderate investors have a medium to long-term horizon and typically diversify their portfolios, combining various asset types.

3. Aggressive

The aggressive investor is willing to take high risks in pursuit of significant returns. This profile usually has a deeper market understanding and invests in:

- Emerging market stocks.

- Cryptocurrencies.

- Equity investment funds (EIFs).

Aggressive investors typically have a long-term horizon, accepting temporary losses in favor of long-term growth.

Setting Financial Goals Aligned with Your Purpose

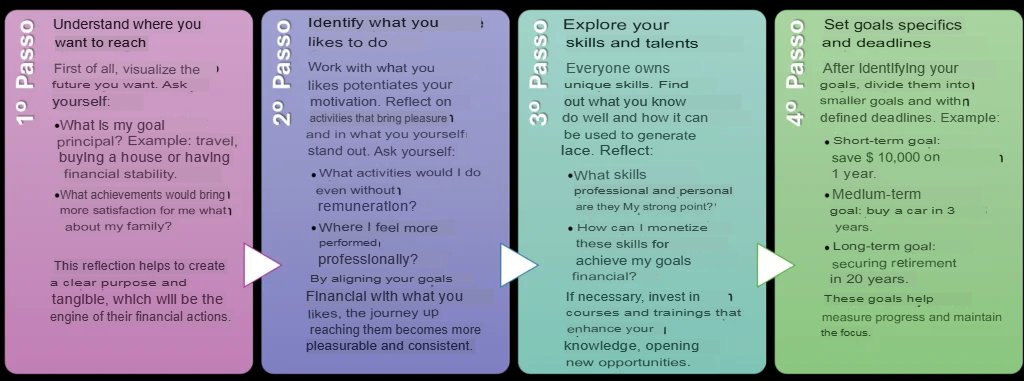

Identifying your investor profile begins with understanding your personal goals. Setting financial objectives goes beyond defining numerical targets — it’s about understanding what truly matters to you, doing what you love, and using your skills to achieve what you desire.

Ask yourself: “What do I want to achieve with my investments?” To do so, follow these steps:

Once you’ve defined your goals, assess your risk tolerance. Reflect on hypothetical scenarios, such as temporarily losing part of your investment. This reflection helps you understand how you would react to market volatility.

Another aspect is your time horizon. The longer the horizon, the greater the potential to take on risks, as there is more time to recover from losses. A well-structured financial plan can be a valuable ally in this process, helping you track progress and stay focused.

Tools and Tests to Identify Your Investor Profile

Today, there are various online tools that can help identify your investor profile. Banks, brokerage firms, and investment platforms offer quick and free tests. These questionnaires assess factors such as:

- Your prior experience with investments.

- Risk and return preferences.

- Financial priorities.

Additionally, financial apps and specialized advisors can supplement this analysis, offering a more detailed diagnosis. It’s important to update your profile periodically, as your goals and risk tolerance may change over time.

The Relationship Between Your Investor Profile and Investment Success

Investing according to your investor profile is one of the key pillars of achieving financial success. This relationship acts like a compass, guiding your choices in line with your goals and preventing deviations that could harm your results.

1. Alignment with Expectations

When investors stick to their profiles, they avoid unpleasant surprises. For example, a conservative investor who decides to invest in high-risk stocks without prior knowledge may become frustrated when facing losses. On the other hand, by following their profile’s guidelines, they keep their expectations realistic and reduce anxiety during market downturns.

2. Greater Resilience in Challenging Scenarios

The financial market is dynamic and often volatile. Investing according to your profile provides greater emotional security, helping you handle fluctuations without making impulsive decisions. An aggressive investor, for example, is prepared to handle temporary losses, while a conservative investor prioritizes capital preservation, even during a crisis.

3. Customized Strategies and Efficiency

Adhering to your profile allows you to create a personalized investment strategy. As a result, your resources are allocated efficiently, maximizing gains within the constraints and possibilities of each investor. This customization increases the chances of success and avoids wasting time and money on unsuitable strategies.

4. Continuous Evolution

Knowing your profile is also a starting point for growth. As investors gain experience and confidence, they can adjust their strategies and even move between profiles. A conservative investor might become moderate after learning more about the market, while an aggressive investor might adopt more cautious strategies during times that require more security.

Ultimately, investing according to your investor profile isn’t just about preference; it’s about intelligent strategy. It protects you from unnecessary risks and increases your chances of achieving your goals consistently and with peace of mind.

Adjusting Your Portfolio to Your Investor Profile

Once you’ve identified your investor profile, the next step is to adjust your investment portfolio. Diversification is key to balancing risks and returns. Here are some tips:

- Conservative: Keep the majority in fixed-income investments and allocate a small portion to more diversified funds.

- Moderate: Combine fixed and variable income assets, seeking a balance between security and growth.

- Aggressive: Increase your exposure to equities but maintain a strategic reserve in safe assets.

Remember to review your portfolio regularly to ensure it remains aligned with your goals and the current economic climate.

Discover Your Investor Profile: Questionnaire

Answer the questions below to discover your profile:

- What is your main goal when investing?

- (a) Preserve capital.

- (b) Balance security and returns.

- (c) Maximize long-term gains.

- How do you feel about fluctuations in the value of your investment?

- (a) Anxious, I prefer stability.

- (b) Tolerant, as long as the gains outweigh the risks.

- (c) Comfortable, I understand it’s part of the process.

- What is your investment time horizon?

- (a) Short-term (up to 2 years).

- (b) Medium-term (2 to 5 years).

- (c) Long-term (over 5 years).

Results:

- Majority (c): Aggressive Profile.

- Majority (a): Conservative Profile.

- Majority (b): Moderate Profile.

Final Insights

- Your investor profile reflects your relationship with risk, goals, and time.

- Knowing it helps avoid emotional decisions and increases your chances of success.

- Use tools and update your profile regularly.

- Align your portfolio with your financial goals.

Remember: Self-awareness is the foundation of a prosperous financial journey. Start exploring your investor profile today and make smarter decisions!

Want to take your financial knowledge even further? 📚💡 Check out our other posts for expert insights, practical tips, and strategies to help you build a secure and prosperous financial future. Explore More Now!

- Caixa Launches Fun Money Game on Roblox

- Easy Ways to Get Robux in Roblox

- Get Free Roblox Items This March

- How to Earn Free Robux Online

- 🍔 Why McDonald’s Became a “Luxury Meal”: The Real Reason Behind the Prices (And How to Beat Them in 2025)