Table of Contents

Millionaire Mindset

“Do you know where you’re heading financially? Or do you feel like life is just carrying you along with the tide?”

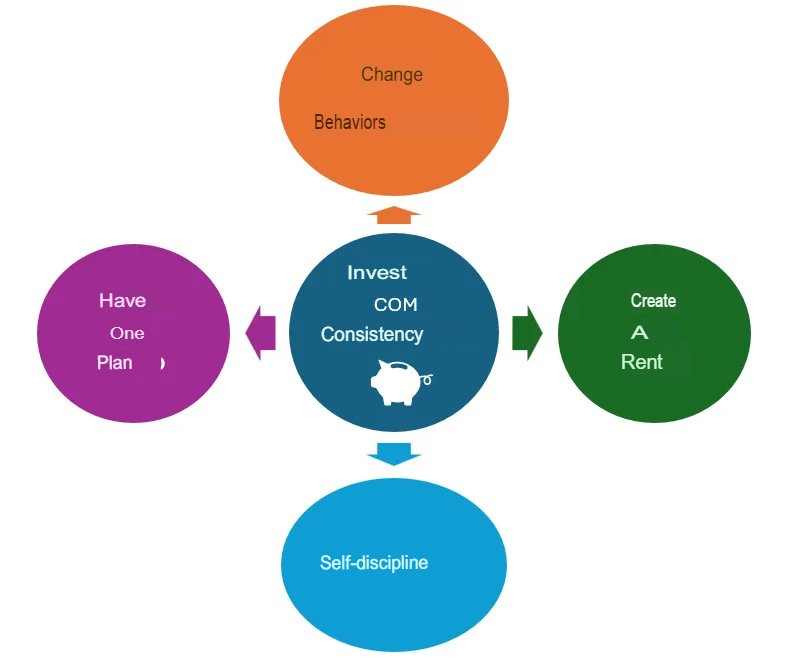

This question makes us reflect on the importance of having an effective financial plan. Financial planning isn’t just about numbers—it’s about turning dreams into achievable goals. Here, you’ll discover the five fundamental pillars for organizing your finances and reaching your goals with confidence.

Pillar 1 – Creating a Plan: Set Clear Goals Before Your Paycheck Arrives

A solid financial plan starts before you even get paid. Knowing how you’ll allocate your income in advance helps prevent impulsive spending and ensures you’re working toward meaningful financial goals.

Start by setting realistic and detailed financial goals, whether it’s paying off debt, investing, or saving for a major milestone. Break down your expenses into fixed and variable categories, prioritize essential spending, and allocate a percentage of your income toward emergency savings and long-term goals.

Using financial planning tools like budgeting apps or spreadsheets can help you track your progress and stay organized. Additionally, reviewing your plan regularly ensures it remains aligned with your changing income and financial priorities.

Pillar 2 – Creating Additional Income: Turn Your Skills into Real Earnings

Relying solely on a paycheck can feel limiting, especially when unexpected expenses arise or you want to achieve financial goals faster. Creating additional income streams is a key pillar of financial success.

Start by assessing your skills and passions. Are you great at baking? Consider selling baked goods. Have expertise in a particular field? Offer freelance services or online tutoring. The key is to find something you enjoy that also has market demand.

Leveraging digital platforms can be a game-changer. Market your services through social media, freelance websites, or e-commerce platforms. Creating multiple income streams not only provides financial security but also accelerates your path to financial freedom.

Pillar 3 – Self-Discipline: The Secret to Smart Financial Choices

Self-discipline is the foundation of good financial habits. Without it, even the best financial plans can fall apart. Discipline means making intentional decisions about spending, saving, and investing—choosing between what you want now and what you want most.

For example, if your goal is to save for an international trip, it might mean cutting unnecessary expenses, cooking at home instead of dining out, or postponing non-essential purchases. It’s about prioritizing long-term rewards over short-term indulgences.

Developing financial discipline also means establishing consistent routines, such as reviewing your budget on a set schedule and tracking spending. Over time, seeing the positive impact of your financial choices will reinforce your motivation to stay on track.

Pillar 4 – The Power of Investing: Turn Dreams into Financial Freedom

Investing is a critical step toward financial stability and independence. It not only helps protect your money from inflation but also allows you to grow wealth over time, reducing reliance on a single source of income.

Start by determining your investor profile and setting clear investment objectives. If your priority is an emergency fund, focus on low-risk, highly liquid options. For long-term goals, consider diversified investments that offer higher returns, even if they involve moderate risk.

Investing also helps reduce financial stress. With a well-structured investment strategy, you can make decisions with confidence rather than out of fear or urgency. Think of investing as a tool for creating a financially secure future—one where you have more options and greater peace of mind.

Pillar 5 – Change Your Money Mindset: Build Habits for Financial Success

Your financial success isn’t just about numbers—it’s about your mindset. Your beliefs and behaviors around money directly impact your ability to build wealth and achieve financial goals.

We’ve previously discussed how emotions and subconscious habits shape financial decisions. (Read more here.) Now, it’s time to put these principles into action.

Now that you know the five key pillars of financial planning, take your first step today! Drop a comment below and share which of these pillars you’re already applying in your daily life.

Want to take your financial knowledge even further? 📚💡 Check out our other posts for expert insights, practical tips, and strategies to help you build a secure and prosperous financial future. Explore More Now!

- Caixa Launches Fun Money Game on Roblox

- Easy Ways to Get Robux in Roblox

- Get Free Roblox Items This March

- How to Earn Free Robux Online

- 🍔 Why McDonald’s Became a “Luxury Meal”: The Real Reason Behind the Prices (And How to Beat Them in 2025)