Discover how digital money and blockchain are revolutionising the future of money and finance. Learn what to expect from cryptocurrencies, instant payment systems like PIX, and central bank digital currencies (CBDCs)!

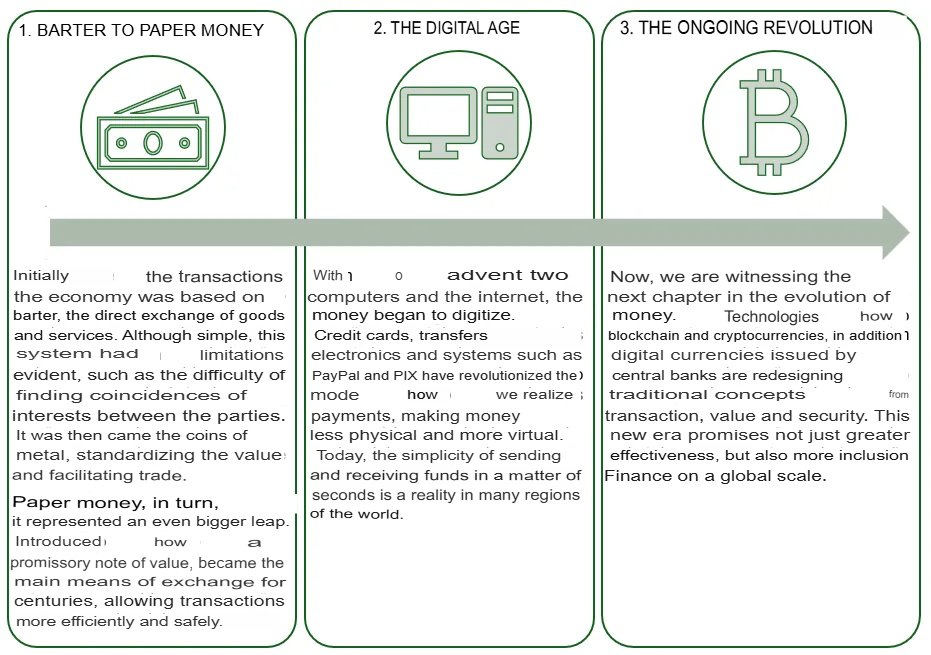

Digital money, in its various forms, has been the foundation of economic relationships throughout human history. From primitive bartering to metal coins, from paper money to the advent of credit cards, each stage has reflected the evolution of society’s needs and technological advancements. Today, we stand at a new crossroads where emerging technologies like blockchain, cryptocurrencies, and digital currencies are poised to dramatically reshape our relationship with money.

The emergence of systems like PIX in Brazil, which facilitates instant transactions, is just one of the signals of this transformation. Moreover, global initiatives like central bank digital currencies (CBDCs), including Brazil’s DREX, open new possibilities for more accessible and secure digital financial transactions.

In this article, we will explore how money has evolved to this point, the challenges posed by emerging technologies, and the trends that will shape the financial future. After all, where are we headed in a world where digital money is becoming increasingly intangible and more integrated with new technologies?

Table of Contents

The Evolution of Money: From Barter to Blockchain

Emerging Technologies Shaping the Future of Money

Blockchain and Cryptocurrencies

Blockchain technology is the backbone of cryptocurrencies like Bitcoin and Ethereum. This innovation allows the creation of decentralised, secure, and immutable records, removing the need for intermediaries in financial transactions. Cryptocurrencies offer speed, transparency, and the potential for financial inclusion for the unbanked populations.

Central Bank Digital Currencies (CBDCs)

Central bank-issued digital currencies are emerging as a solution to modernise financial systems. DREX, for example, promises to increase transaction efficiency and reduce operational costs. These currencies combine the security of traditional financial institutions with the agility of digital technologies.

Asset Tokenisation

Another important development is asset tokenisation. This process allows physical assets, such as real estate or artwork, to be converted into digital tokens. This innovation is democratising access to investments and expanding options for financial diversification.

Challenges on the Road to the Future of Money

Privacy and Security

As money becomes more digital, concerns about data privacy and transaction security are increasingly relevant. Blockchain technology offers promising solutions, but it also raises questions about traceability and anonymity. Moreover, vulnerability to cyberattacks poses a significant challenge for governments and financial institutions.

Financial Inclusion

Although digital innovations expand access to the financial system, there are still challenges for populations in remote areas or without internet access. Creating accessible and inclusive solutions will be essential to ensure everyone can benefit from these technologies.

Regulation and Policies

Regulation is another crucial point. Governments and regulatory bodies face the challenge of balancing innovation with consumer protection and economic stability. Clear and consistent laws will be necessary to foster trust in the new financial ecosystem without stifling technological progress.

Trends for the Future of Money

The Convergence of Physical and Digital

In the future, physical and digital money are expected to coexist, but with a growing predominance of digital. Integrated systems will allow individuals and businesses to easily transition between these forms, fostering a more agile and connected economy.

Invisible Payments

Technologies such as the Internet of Things (IoT) and payments via facial recognition or biometrics are driving the idea of “invisible payments”. In this scenario, financial transactions will be automatic and almost imperceptible, enhancing user experience.

Decentralised Economy

Decentralisation, driven by blockchain, could radically transform sectors like finance, insurance, and contracts. Decentralised finance (DeFi) offers alternatives to traditional systems, granting users greater autonomy and control.

Sustainability and Inclusion

Beyond efficiency, the future of money will also be guided by environmental and social concerns. Sustainable and inclusive solutions will be prioritised to meet the demands of a globally connected society.

How Blockchain Can Change Finance

Blockchain is a revolutionary technology with the potential to deeply transform the financial sector by eliminating intermediaries, reducing costs, and improving transaction efficiency. With its decentralised technology, it offers transparency and security, combating fraud and money laundering. Additionally, it enables the creation of smart contracts, which automate agreements, and the tokenisation of assets, democratizing previously inaccessible investments. The rise of decentralised finance (DeFi) and the inclusion of people without access to traditional banking are other significant impacts.

In summary, blockchain is redefining finance, making it more accessible, secure, and innovative.

The future of money is being shaped by unprecedented technological advances and a growing desire for financial inclusion and security. From the earliest exchanges to the tokenisation of assets, the evolution of money reflects humanity’s ability to innovate and adapt.

Conclusion: The Future of Digital Money

To fully harness these trends, it will be essential to balance innovation with regulation, ensuring that everyone can equally participate in this new financial era.

Key Questions about Digital Money 💸✨

📌 FAQ: The Future of Money and Blockchain

How can I prepare for the future of money?

To prepare, follow trends in financial technology, invest in education about blockchain and cryptocurrencies, and stay alert to innovations such as DREX and asset tokenisation solutions.

What is the future of money?

The future of money is directly linked to the digitalisation of finance, with technologies like blockchain, cryptocurrencies, and central bank digital currencies (CBDCs). The trend is for physical money to lose ground, while digital solutions become increasingly dominant.

How is blockchain changing finance?

Blockchain is revolutionising finance by offering a decentralised, secure, and transparent system of record. It eliminates intermediaries in financial transactions and enables the creation of cryptocurrencies like Bitcoin and Ethereum, as well as the tokenisation of assets.

What are central bank digital currencies (CBDCs)?

CBDCs are digital versions of traditional currencies issued by central banks. They offer security, efficiency, and agility for financial transactions. For example, Brazil’s DREX promises to facilitate digital payments and reduce costs.

Is PIX part of the future of money?

Yes! PIX is already an important part of Brazil’s digital financial transformation. It enables instant transactions 24/7 and serves as a foundation for future financial innovations in the country.

What is asset tokenisation?

Tokenisation transforms physical assets, such as real estate and artwork, into digital tokens. This makes it easier to access investments, democratises market participation, and offers new options for financial diversification.

What are the main challenges for the future of money?

Key challenges include digital security, data privacy protection, financial inclusion for populations without internet access, and creating appropriate regulations for these new technologies.

Will physical money disappear?

Not immediately. It is likely that physical and digital money will coexist for some time, but the trend is for digital transactions to become more prevalent, especially with the advancement of technologies.

What are invisible payments?

Invisible payments are automated financial transactions that don’t require direct user action. Technologies like facial recognition, biometrics, and IoT are driving this trend.

What trends will dominate the financial future?

Key trends include digital currencies, the use of blockchain for decentralised finance (DeFi), invisible payments, and sustainable and inclusive solutions for a more globally connected economy.

Want to take your financial knowledge even further? 📚💡 Check out our other posts for expert insights, practical tips, and strategies to help you build a secure and prosperous financial future. Explore More Now!

- Caixa Launches Fun Money Game on Roblox

- Easy Ways to Get Robux in Roblox

- Get Free Roblox Items This March

- How to Earn Free Robux Online

- 🍔 Why McDonald’s Became a “Luxury Meal”: The Real Reason Behind the Prices (And How to Beat Them in 2025)