Starting January 1, 2025, the federal minimum wage in the United States remains at $7.25 per hour, unchanged since 2009. However, several states and cities have implemented their own minimum wage laws, with some exceeding $15 per hour to adjust for the cost of living.

The minimum wage plays a crucial role in economic policies, impacting millions of American workers and businesses. While some advocate for higher wages to improve living standards, others warn of potential challenges for small businesses. Understanding how these wage policies affect daily life and exploring strategies to navigate changes is essential.

This article explores the details behind the U.S. minimum wage system, how it is determined, and its effects on the economy. Additionally, we will examine where workers typically spend their earnings and how they can better plan their finances. Let’s dive in!

Table of Contents

How Is the Minimum Wage Determined in the U.S.?

Have you ever wondered how the government sets the minimum wage? In the United States, the federal minimum wage is determined by Congress and enforced by the Fair Labor Standards Act (FLSA). However, states and local governments have the authority to establish higher minimum wages based on economic conditions.

For example, in 2025, states like California ($16 per hour) and Washington ($16.28 per hour) have significantly higher minimum wages compared to the federal rate. Some states, such as Texas and Georgia, still adhere to the $7.25 per hour minimum.

Additionally, some cities set their own higher minimum wages. For instance, Seattle’s minimum wage is $19.97 per hour, reflecting the city’s high cost of living.

While raising the minimum wage can boost workers’ purchasing power, it also presents challenges for small businesses, which may need to adjust their budgets or reduce hiring.

Minimum Wage Trends Over the Last Decade

To better understand the impact of minimum wage changes, here is an overview of the federal minimum wage over the last ten years:

| Year | Federal Minimum Wage ($/hour) | Change (%) |

|---|---|---|

| 2015 | 7.25 | 0% |

| 2016 | 7.25 | 0% |

| 2017 | 7.25 | 0% |

| 2018 | 7.25 | 0% |

| 2019 | 7.25 | 0% |

| 2020 | 7.25 | 0% |

| 2021 | 7.25 | 0% |

| 2022 | 7.25 | 0% |

| 2023 | 7.25 | 0% |

| 2024 | 7.25 | 0% |

| 2025 | 7.25 | 0% |

This table shows that the federal minimum wage has remained unchanged since 2009, despite inflation and increases in the cost of living. However, individual states and cities have implemented their own increases, leading to significant variations across the country.

The Impact of Minimum Wage on the U.S. Economy

Minimum wage adjustments have a direct impact on the U.S. economy, particularly for low-wage workers. Higher minimum wages can increase consumer spending, benefiting businesses and local economies. However, they can also lead to higher operating costs for small businesses, which may pass these costs onto consumers through price increases.

According to the Bureau of Labor Statistics (BLS), approximately 1.1 million workers earned at or below the federal minimum wage in 2023. Many of these workers rely on additional income sources or government assistance to meet their basic needs.

The impact of minimum wage changes varies by region. States with a higher cost of living generally implement their own minimum wage laws to ensure workers can afford basic necessities. Conversely, states with lower living costs often adhere to the federal standard.

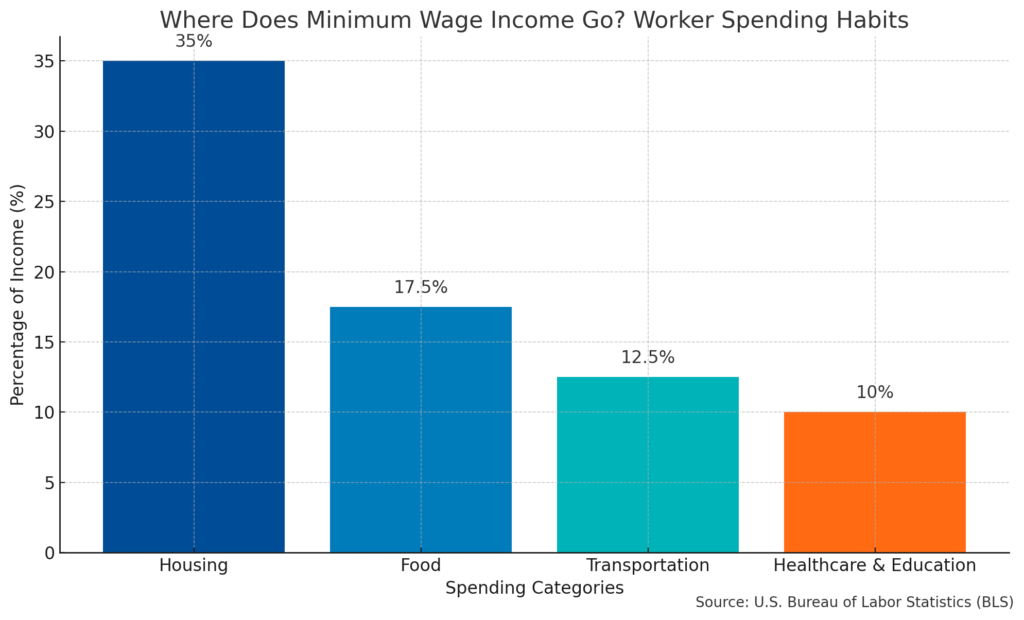

Where Does Minimum Wage Income Go? Worker Spending Habits

Now that we understand how the minimum wage is determined, let’s explore how workers typically spend their earnings. Studies indicate that most of the minimum wage is allocated to essential expenses such as housing, food, and transportation. Below is a breakdown of these categories:

- Housing: Rent or mortgage payments account for 30-40% of a minimum wage worker’s budget, depending on location.

- Food: Around 15-20% is spent on groceries and dining.

- Transportation: Public transit, gas, or car maintenance costs represent 10-15% of expenses.

- Healthcare & Education: These categories consume about 10% of earnings, particularly for families with dependents.

For workers earning the federal minimum wage, affording basic necessities can be challenging, often requiring multiple jobs or government assistance programs.

Challenges and Opportunities for Minimum Wage Workers

Living on the federal minimum wage can be difficult, but there are opportunities for those looking to improve their financial situation. One of the biggest challenges is the rising cost of living, especially in major metropolitan areas where rent, transportation, and food expenses are significantly higher.

However, there are ways to enhance financial stability:

- Upskilling and education: Free or affordable vocational programs can lead to higher-paying job opportunities.

- Side businesses: Many workers supplement their income through gig work, freelancing, or selling products online.

- Budgeting and financial planning: Smart money management, avoiding unnecessary debt, and prioritizing savings can improve long-term financial health.

KEY TAKEAWAYS: Final Insights and Financial Planning Tips

As we wrap up this guide on the U.S. minimum wage in 2025, here are the key points to remember:

- The federal minimum wage remains at $7.25 per hour, but many states and cities have implemented higher wages.

- Housing and food are the largest expenses for minimum wage workers.

- Professional development and financial literacy are critical for improving quality of life.

- Minimum wage policies impact both workers and businesses, shaping the broader economy.

If you’re earning minimum wage, start planning your finances today. Consider budgeting, exploring higher-paying opportunities, and investing in skill development. Even small changes can lead to significant long-term improvements in financial stability.

Want to take your financial knowledge even further? 📚💡 Check out our other posts for expert insights, practical tips, and strategies to help you build a secure and prosperous financial future. Explore More Now!

- Caixa Launches Fun Money Game on Roblox

- Easy Ways to Get Robux in Roblox

- Get Free Roblox Items This March

- How to Earn Free Robux Online

- 🍔 Why McDonald’s Became a “Luxury Meal”: The Real Reason Behind the Prices (And How to Beat Them in 2025)