Managing household finances is like using a compass—it guides you and your family toward financial stability and the achievement of your goals.

However, without proper control over expenses, making well-informed financial decisions becomes even more challenging. It also increases the risk of falling into financial traps, such as excessive debt. Despite seeming complicated, establishing a routine for managing expenses can be simpler than many imagine. Unfortunately, many families neglect this essential habit. The key lies in taking small, manageable steps—easy to implement but also easy to ignore without commitment.

If you’re looking to get out of debt or simply improve your financial well-being, this article provides practical insights and tools to help you achieve that goal.

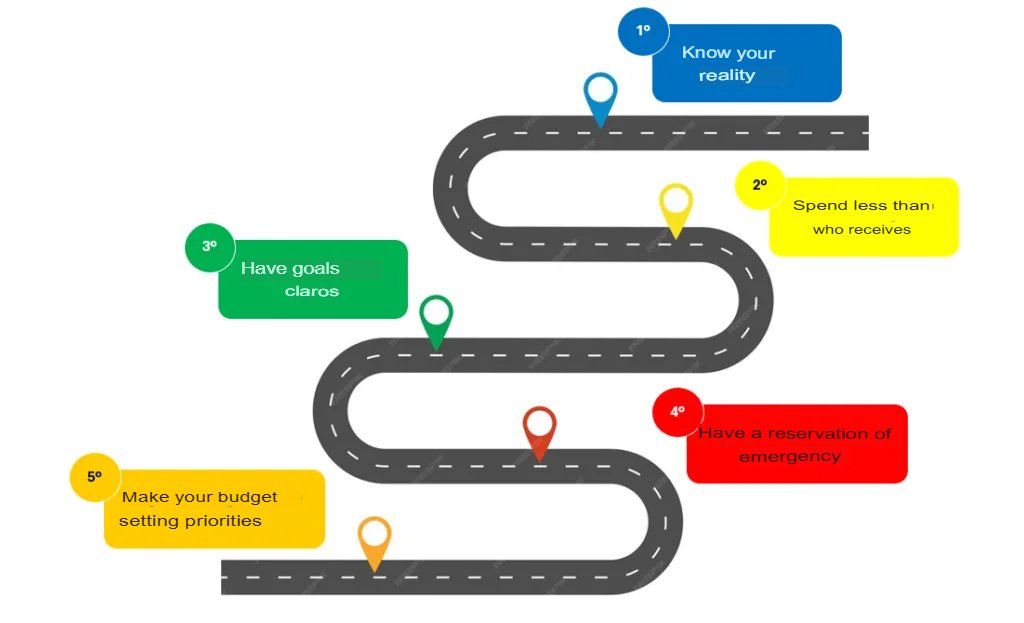

Mastering your finances is a journey, and the first step is planning and organization.

Table of Contents

Financial Planning: The First Step to Transformation

Planning is the foundation of any significant change. The first step to successful household financial management is identifying your family’s income sources and tracking where the money is going. Without this financial snapshot, making informed decisions is nearly impossible.

Take time to list all fixed monthly expenses, such as rent, utilities, and transportation. Then, include variable expenses like groceries, entertainment, and unplanned purchases. This process creates a clear picture of your financial situation.

Another crucial step is setting priorities. Ask yourself: which expenses can be reduced or eliminated? Cutting unnecessary spending is a major step toward balancing your finances and saving for the future.

Financial Diagnosis: Understanding Your Current Situation

If you want to improve your finances, understanding your current situation is essential. A financial diagnosis works like an X-ray, revealing the strengths and weaknesses of your money management.

Start by reviewing your bank balance and statements from the last three months. This is an effective way to identify spending patterns that may be draining your savings. Small expenses, such as frequent coffee shop visits or multiple subscriptions, may seem insignificant, but when added up, they can have a significant financial impact.

Next, assess your debts. List all loans, credit cards, and other financial obligations. Knowing exactly how much you owe is crucial for prioritizing payments and avoiding growing interest charges. This control helps prevent the notorious “snowball effect” of compounding debt.

Finally, organize your finances visually. Use a spreadsheet or financial apps to categorize income and expenses. This makes it easier to track progress and make informed financial decisions.

How to Set Clear and Achievable Financial Goals

Setting financial goals bridges the gap between your present situation and the future you want to build. Effective financial management starts with clear objectives that guide your daily actions.

First, write down your financial goals. They should be specific, measurable, achievable, relevant, and time-bound (SMART). For example, “Save $10,000 for an emergency fund within 12 months” is a clear and realistic goal.

Break down goals into short-, medium-, and long-term objectives. Buying a new appliance could be a short-term goal, while purchasing a home or securing retirement savings falls under long-term planning. Having different timeframes helps maintain focus on multiple financial horizons.

Adjust goals based on your reality. They should be challenging but attainable. Avoid unrealistic targets that may lead to frustration and demotivation.

Practical Strategies to Improve Financial Organization

Small changes can lead to significant financial improvements. Consider these simple strategies:

- Weekly review: Spend 30 minutes each week reviewing your finances. This helps correct spending mistakes and adjust plans in real-time.

- Monthly budgeting: Set a spending limit for each expense category. This prevents you from overspending.

- Emergency fund: Save at least 10% of your monthly income for unexpected expenses. A well-structured emergency fund protects your family from financial crises.

How to Involve the Whole Family in Financial Planning

Household financial management should not fall on one person alone—it’s a team effort. When everyone participates, planning becomes more effective, and results come faster.

Start by having open conversations about household finances. Explain the importance of saving and prioritizing essential expenses. Create an environment where family members can share opinions and suggest solutions.

Set family financial goals. For example, saving for a vacation or a home renovation can serve as motivation for everyone to contribute. Offering rewards for achieving savings goals can also help maintain enthusiasm.

Finally, delegate financial responsibilities. Children can learn about money management by saving a portion of their allowance, while adults handle major expenses. This collaborative approach fosters financial awareness and responsibility.

Tools to Manage Your Money

Today, various tools can simplify household financial management. Using them can make the process faster and more efficient. Financial tracking apps help categorize expenses and monitor your budget in real-time.

Another effective method, in addition to digital tools, is the envelope budgeting system—allocating physical cash into envelopes designated for specific expenses. While traditional, this approach remains useful for many families.

Key Takeaways: The Power of Consistent Small Steps

Achieving household financial organization requires discipline, but the rewards are long-lasting. Remember that small, consistent actions lead to significant results over time:

- Track all income and expenses.

- Set realistic and attainable financial goals.

- Involve your family in financial planning.

- Use tools to simplify financial management.

- Regularly review progress and adjust plans as needed.

With dedication and consistency, you can build a more secure and prosperous financial future for yourself and your family.