Table of Contents

Blockchain and the World of Cryptocurrencies

Cryptocurrencies are not just a passing trend in the financial market. They are reshaping the global economy and capturing the attention of investors, entrepreneurs, and even governments. With the exponential growth of coins like Bitcoin and Ethereum, the idea of decentralized digital money is becoming increasingly tangible. But how do cryptocurrencies really work? And why do they continue to attract so much interest?

In essence, cryptocurrencies are “digital currencies” that operate on a decentralized network called blockchain. Unlike traditional money, they do not rely on intermediaries like banks or governments to validate or control transactions. The security and transparency provided by blockchain technology are among the primary reasons why cryptocurrencies are gaining popularity, particularly among those looking to diversify their investments.

In this article, we will explore what cryptocurrencies are, how they work, the reasons behind their rise, and how you can benefit from this market. Whether you are just starting to take an interest in crypto or are already investing but want to deepen your knowledge, this guide is for you.

What Are Cryptocurrencies?

Cryptocurrencies are digital forms of money that operate on a decentralized network without the need for intermediaries like banks or governments. Their main feature is the use of cryptography to secure transactions and verify the creation of new units. Unlike traditional money, which is controlled by a central authority, cryptocurrencies are based on a distributed system that enables direct transactions between parties.

Bitcoin, created in 2009 by an individual or group under the pseudonym Satoshi Nakamoto, was the first cryptocurrency to gain popularity. Since then, hundreds of other coins have been created, such as Ethereum, Litecoin, and even meme coins like Dogecoin. While each of these coins functions similarly, they have distinct characteristics and use cases. However, they all share the same essence: they operate on a decentralized blockchain network without requiring a central authority.

How Do Cryptocurrencies Work?

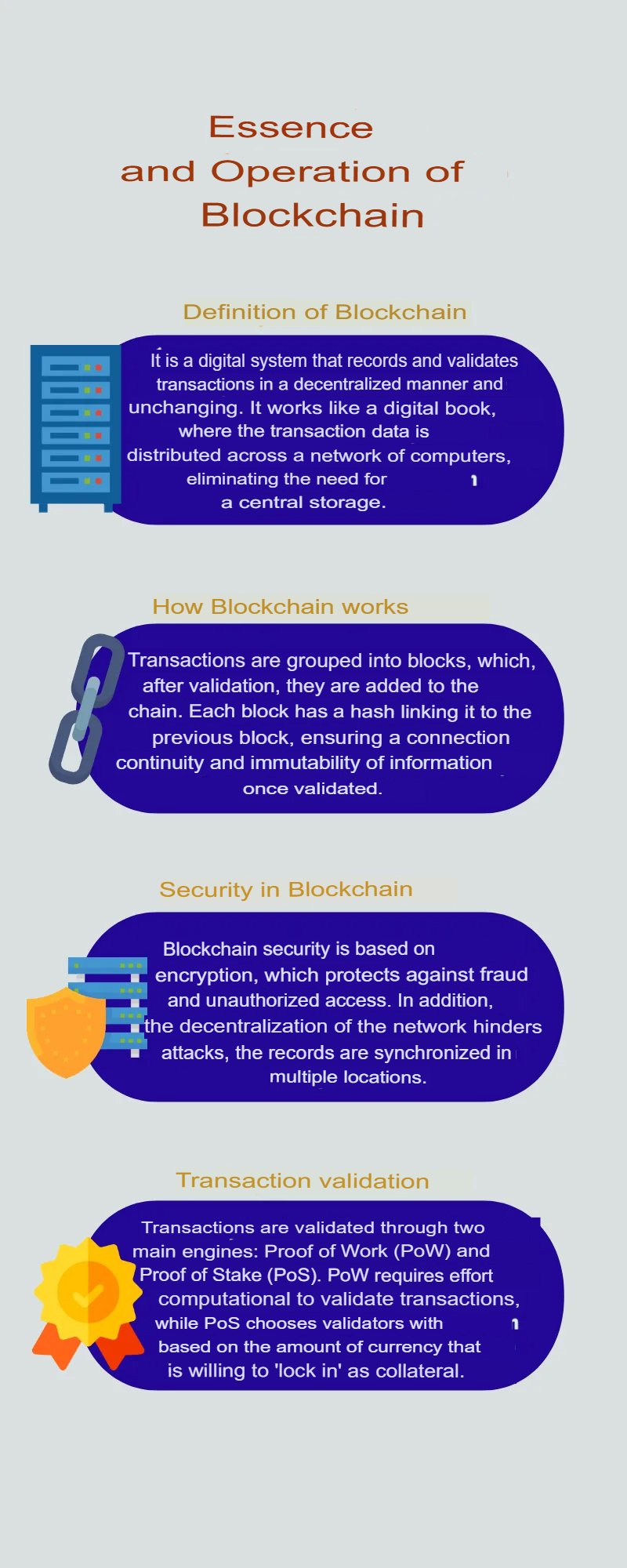

The technology behind cryptocurrencies is one of their greatest innovations: blockchain. Simply put, a blockchain is a digital ledger that records all transactions made with a specific cryptocurrency. It is maintained by a network of computers (nodes) that validate and verify each transaction, ensuring there are no frauds or double spending.

Major Cryptocurrencies and Their Differences

Although Bitcoin is the most well-known cryptocurrency, many others offer unique functionalities and serve different purposes. Let’s explore some of the leading cryptocurrencies:

- Bitcoin (BTC): The first cryptocurrency, created as a decentralized digital currency and a store of value. Bitcoin has a limited supply of 21 million coins, making it increasingly valuable over time.

- Ethereum (ETH): Beyond functioning as a currency, Ethereum allows the creation of smart contracts and decentralized applications (dApps). It serves as a platform for other cryptocurrencies and blockchain projects, making it one of the largest blockchain ecosystems.

- Litecoin (LTC): Created as a faster and more accessible version of Bitcoin, Litecoin has shorter transaction times and a larger supply of coins. It became popular due to its similarities with Bitcoin but with a more agile approach.

- Ripple (XRP): Focused on fast and low-cost transactions between banks and financial institutions, Ripple offers an efficient solution for international payments. However, its network is not as decentralized as other cryptocurrencies, sparking some controversy in the market.

These cryptocurrencies, along with others like Cardano, Polkadot, and Binance Coin, are creating a diverse ecosystem that serves a wide range of needs, from simple digital payments to complex application development.

Why Are Cryptocurrencies on the Rise?

The growth of cryptocurrencies in recent years is no accident. Several factors are driving their popularity and attracting more investors and entrepreneurs. Here are some of the main reasons:

- Decentralization and Financial Independence: Cryptocurrencies offer an alternative to the traditional financial system, allowing individuals to control their own assets without relying on a bank or government.

- Potential for Appreciation: Cryptos like Bitcoin and Ethereum have experienced impressive price increases, attracting investors seeking substantial gains. The concept of digital scarcity has led many to view cryptocurrencies as valuable investments, similar to gold.

- Innovative Technology: Blockchain, the backbone of cryptocurrencies, is considered one of the most promising technological advancements. It provides a secure, transparent, and decentralized way to record transactions, with potential applications in finance, healthcare, and supply chain management.

- Institutional Adoption: Large companies and institutional investors, such as Tesla, Square, and MicroStrategy, have started investing in Bitcoin, bringing more legitimacy to the crypto market. Additionally, governments worldwide are exploring cryptocurrency regulations and even developing their own digital currencies (CBDCs).

These factors, combined with increasing interest from both individuals and experts, indicate that cryptocurrencies are on the rise like never before. They have not only changed how we think about money but also opened up new possibilities for investors, businesses, and even governments.

Advantages and Disadvantages of Cryptocurrencies

Cryptocurrencies are often praised for their innovation and impact on the global financial market. However, like any technology, they have pros and cons. Let’s examine the key points:

Advantages:

- Decentralization and Financial Autonomy: Users have full control over their assets without relying on financial institutions.

- Security and Transparency: Blockchain technology provides a high level of security, with every transaction recorded in an immutable, encrypted ledger.

- Lower Transaction Costs: Many cryptocurrency networks charge significantly lower fees than traditional banks and payment systems, especially for international transfers.

- Global Accessibility: Cryptocurrencies are available to anyone with internet access, regardless of their location or banking status.

Disadvantages:

- Price Volatility: The extreme price swings of cryptocurrencies can pose risks for investors seeking stability.

- Lack of Regulation: The decentralized nature of cryptocurrencies makes them vulnerable to fraud, theft, and market manipulation.

- Slow Mass Adoption: Many people still lack understanding of how cryptocurrencies work, limiting widespread use.

- Scalability Issues: As transaction volumes grow, some cryptocurrencies struggle with speed and cost efficiency, though solutions are being developed.

Investing in Cryptocurrencies Safely

While investing in cryptocurrencies can be highly profitable, it also involves significant risks. Here are some key tips for safe investing:

- Do Your Research: Understand how a cryptocurrency works before investing.

- Use Secure Wallets: Hardware wallets offer better security than online wallets.

- Diversify Your Portfolio: Avoid putting all your money into one cryptocurrency.

- Be Aware of Volatility: Consider long-term investment strategies to mitigate short-term price swings.

- Protect Your Private Keys: Never share your private keys and use two-factor authentication (2FA).

Regulation and the Future of Cryptocurrencies

Although cryptocurrencies operate outside direct government control, growing adoption has led many countries to consider clearer regulations. The future of cryptocurrencies will depend on how governments and regulatory bodies approach these new financial assets.

The rise of central bank digital currencies (CBDCs), which are government-issued digital currencies, could further change the landscape. Unlike decentralized cryptocurrencies, CBDCs remain under government control, raising questions about the balance between innovation and regulation in the digital finance space.

The Impact of Cryptocurrencies – Final Insights

Cryptocurrencies are not just an alternative to traditional money; they represent a shift in economic power. As decentralization becomes more widespread, we must ask:

- How will the traditional financial system adapt to this transformation?

- Will cryptocurrencies empower financial freedom or become a new battleground for digital control?

One thing is certain: cryptocurrencies and digital finance are no longer on the horizon—they are here, actively reshaping our financial reality. Whether you are an investor or entrepreneur, understanding this movement is crucial for positioning yourself strategically in the future economy.

- Caixa Launches Fun Money Game on Roblox

- Easy Ways to Get Robux in Roblox

- Get Free Roblox Items This March

- How to Earn Free Robux Online

- 🍔 Why McDonald’s Became a “Luxury Meal”: The Real Reason Behind the Prices (And How to Beat Them in 2025)